Key Aspects to Consider When Making An Application For an Equity Car Loan

When taking into consideration making an application for an equity financing, it is important to browse through different key elements that can significantly influence your monetary health - Equity Loans. Comprehending the kinds of equity finances available, assessing your qualification based upon financial aspects, and carefully analyzing the loan-to-value proportion are necessary first steps. However, the intricacy grows as you look into comparing rate of interest, fees, and payment terms. Each of these factors plays a crucial function in establishing the total cost and feasibility of an equity finance. By meticulously scrutinizing these components, you can make enlightened choices that straighten with your lasting economic objectives.

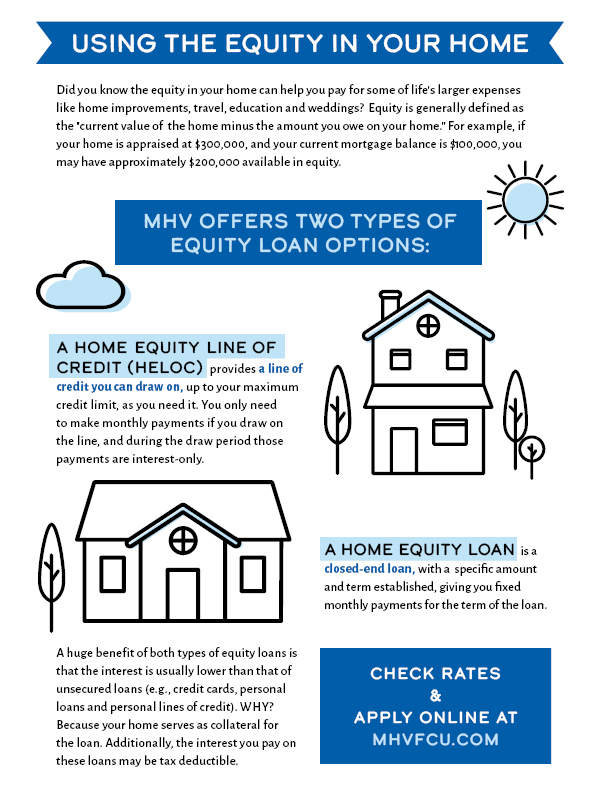

Types of Equity Financings

Various economic organizations provide a series of equity finances tailored to fulfill varied borrowing requirements. One typical kind is the conventional home equity funding, where homeowners can obtain a swelling sum at a set rate of interest, utilizing their home as collateral. This kind of loan is suitable for those who require a large sum of cash upfront for a certain function, such as home renovations or financial debt consolidation.

One more preferred choice is the home equity credit line (HELOC), which operates a lot more like a bank card with a revolving debt limitation based upon the equity in the home. Borrowers can attract funds as needed, as much as a particular limit, and only pay rate of interest on the quantity used. Equity Loans. HELOCs are ideal for recurring expenses or projects with uncertain prices

Additionally, there are cash-out refinances, where home owners can refinance their existing home loan for a greater quantity than what they get the distinction and owe in cash money - Alpine Credits Home Equity Loans. This type of equity finance is beneficial for those looking to make the most of reduced rates of interest or access a big amount of cash without an added monthly repayment

Equity Finance Qualification Variables

When considering eligibility for an equity car loan, monetary organizations normally analyze elements such as the applicant's credit history, income stability, and existing debt obligations. An important element is the credit report, as it shows the debtor's credit reliability and capacity to pay off the finance. Lenders like a higher credit history score, normally over 620, to reduce the risk connected with borrowing. Revenue stability is another essential element, showing the consumer's capability to make routine finance repayments. Lenders may need proof of regular earnings through pay stubs or income tax return. Additionally, existing financial debt commitments play a significant duty in figuring out qualification. Lenders review the debtor's debt-to-income ratio, with reduced ratios being more favorable. This proportion indicates just how much of the borrower's revenue goes towards paying off debts, affecting the lender's choice on car loan authorization. By thoroughly assessing these factors, banks can establish the applicant's qualification for an equity loan and develop ideal loan terms.

Loan-to-Value Proportion Factors To Consider

Lenders usually like lower LTV proportions, as they use a better padding in case the debtor defaults on the finance. Borrowers must intend to keep their LTV proportion as reduced as feasible to boost their possibilities of approval and safeguard a lot more positive finance terms.

Rate Of Interest Prices and Fees Contrast

Upon assessing interest prices and fees, customers can make educated choices concerning equity financings. Rate of interest prices can considerably influence the overall cost of the funding, influencing monthly repayments and the total amount paid off over the loan term.

Apart from passion prices, consumers need to likewise think about the different fees associated with equity car loans. Prepayment penalties my sources might use if the debtor pays off the finance early.

Settlement Terms Analysis

Reliable analysis of payment terms is essential for customers seeking an equity lending as it directly impacts the financing's price and monetary results. When evaluating repayment terms, consumers need to carefully review the loan's duration, month-to-month settlements, and any kind of prospective charges for early settlement. The financing term describes the size of time over which the debtor is expected to pay back the equity lending. Shorter car loan terms typically lead to higher regular monthly payments however reduced general passion expenses, while longer terms offer reduced monthly repayments yet may bring about paying more interest with time. Customers require to consider their financial scenario and goals to figure out one of the most suitable settlement term for their needs. Additionally, recognizing any charges for very early repayment is vital, as it can affect the versatility and cost-effectiveness of the car loan. By completely assessing payment terms, consumers can make informed decisions that line up with their monetary purposes and ensure successful loan administration.

Final Thought

To conclude, when applying for an equity car loan, it is very important to think about the kind of finance readily available, qualification aspects, loan-to-value ratio, rates of interest and fees, and settlement terms - Alpine Credits Home Equity Loans. By very carefully examining these essential elements, customers can make informed choices that straighten with their economic goals and situations. It is critical to extensively research study and compare choices to guarantee the most effective feasible end result when seeking an equity car loan.

By carefully assessing these variables, monetary institutions can establish the applicant's qualification for an equity finance and establish ideal loan terms. - Home Equity Loans

Passion rates can significantly influence the overall price of the funding, affecting month-to-month settlements and the overall quantity paid off over the lending term.Efficient assessment of settlement terms is essential for debtors looking for an equity lending as it straight influences the funding's price and financial results. The loan term refers to the length of time over which the customer is anticipated to repay the equity finance.In conclusion, when applying for an equity finance, it is important to think about the kind of financing available, qualification elements, loan-to-value proportion, interest rates and charges, and payment terms.

Comments on “Recognizing Home Equity Loans: Unlocking Your Home's Value”